Porto Alegre, November 15, 2021 – While Brazilian beef and pork exports cope with a strong dependence on China, chicken exports are more independent and show an excellent performance this year. The absence of outbreaks of bird flu in Brazil is a determining factor that offers an even brighter trend for the sector. Halal shipping also needs to be considered in this context to understand the advance of Brazilian chicken exports, with Brazil as the undisputed leader in this segment.

For other proteins, the priority focus continues on Chinese actions in the international market, with a clear strategy of retraction of imports aimed at reducing domestic supply in recent weeks, as could be seen with the recent behavior of prices, which found room for reaction in China. As discussed in previous publications, China used some strategies to achieve price hikes in its pig farming:

– Cut in imports. October and November were months of reduction in the volume of meat imports by China. In this sense, the drop in Brazilian pork exports is quite emblematic, with China importing only 22,000 tons of pork, the lowest volume since August 2019. The embargo on Brazilian beef is also an element that justifies the decline in Chinese imports. In November, China imported around 677,000 tons, a small volume of purchases for Chinese standards, which for the last two and a half years involved more than 1 million tons a month;

– Purchase of meat in the domestic market to build public stocks. Aiming at reducing the domestic supply, China also bought meat in the domestic market to build its public stocks, more than 100,000 tons were purchased in recent weeks. In 2022, in the event of an abrupt rise in prices, the Chinese government may put its reserves into the market to balance the situation.

In the case of beef, Brazil has already exported around 2.5 million tons in carcass equivalent from January to November. Until September, the performance was spectacular, however, the weight of China since the embargo impacts the result in terms of volume and revenue. In 2021, there was a decrease of almost 8% from the same period last year. In terms of revenue, the balance is still positive, with a growth of 9%, even so the revenue that was not collected will make a great difference to the segment.

Regarding pork, the balance of exports to China was very positive this year until November, when there was the lowest volume exported since August 2019. From January to November, Brazil exported around 1 million tons of pork, up 10.85% from the same period last year. In terms of revenue, growth is even more significant, at around 17.3%.

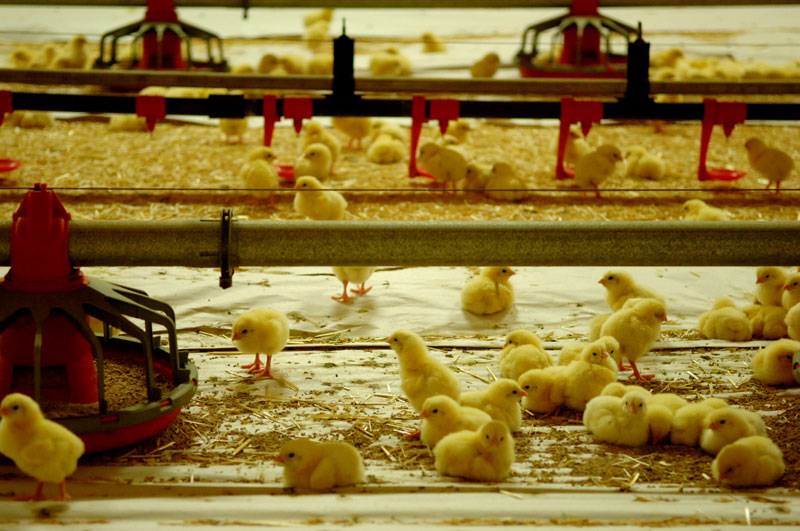

As for chicken, there are many highlights during the year about exports, Brazil managed to advance satisfactorily in a segment in which it is the undisputed leader in shipments, with emphasis on exports to the United Arab Emirates, Japan, South Africa, and the Netherlands. The dependence on China is much lower compared to other proteins. From January through November, Brazil exported around 4.07 million tons of chicken, an increase of 8.15% over the same period last year. The revenue growth of approximately 25% is even more emblematic.

In 2022, some issues need to be clarified around China, starting with its import potential next year, the country will not likely act as aggressively as in previous years. This does not mean that China will not import significant volumes of animal protein, but that it will act in a less incisive manner, maintaining its traditional proactivity in matters involving food safety. It is quite probable that there will be a renegotiation of contracts aimed at reducing import prices, a measure that has already been adopted this year and tends to intensify in 2022.

Regarding the domestic market, the trend is that Brazilians still cope with inflationary processes in 2022, limiting the population’s consumption power. In addition, macroeconomic difficulties reinforce the tendency to maintain the consumption of proteins that have a lower impact on average income. In other words, chicken will again be the favorite meat of Brazilian consumers.

SAFRAS Latam